Shares in Asia traded broadly higher ahead of Wednesday’s Federal Reserve decision. The yen strengthened from near its weakest level this year after Japan’s foreign exchange chief said he was on standby for intervention.

MSCI’s Asia Pacific Index rose about 1%, led higher by Japanese stocks, with the Topix benchmark gaining the most in a year. Shares in Hong Kong and mainland China fluctuated after a private survey showed China’s manufacturing activity contracted. S&P 500 futures edged lower after the index rebounded in the final day of October.

ADVERTISEMENT

CONTINUE READING BELOW

Treasury 10-year yields ticked marginally lower after rising in the previous session. Traders are taking the latest US economic data in stride as they expect another interest-rate hold decision from the Fed. Focus is also on the US government’s new borrowing plan, due hours ahead of the Fed’s announcement.

Meanwhile, China’s central bank withdrew cash from the financial system, suggesting it sees the previous day’s abrupt surge in short-term borrowing costs as a temporary disruption.

The Bank of Japan announced unscheduled bond-purchase operations to curb gains in yields following its policy decision. The 10-year Japanese government bond yield touched a fresh decade high of 0.97% after the BOJ on Tuesday said it will take a more flexible approach to controlling rates on 10-year government debt.

“We expect higher interest rates to be positive for Japan’s financial stocks while we don’t expect a significant negative impact on growth stocks, given that the rise in long-term interest rates in the country will be minor and Japanese corporations are cash rich,” Rie Nishihara, chief Japan equity strategist at JPMorgan Securities, wrote in a note.

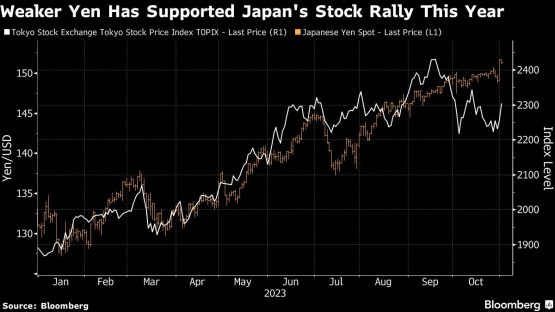

For currency traders, BOJ’s policy tweaks appeared to fall short of offering a clearer sign of progress toward monetary tightening. The yen saw its biggest one-day drop since April, which sent it toward the 152 level, which a year ago drove Japanese authorities to swoop in to prop up the currency.

The yen extended gains Wednesday after Japan’s chief currency official Masato Kanda said authorities see some moves that aren’t in line with fundamentals and are on standby to intervene if needed.

The Bloomberg Dollar Spot Index edged higher after advancing 0.4% in the previous session on the back of yen’s weakness.

In economic news, US consumer confidence dropped to a five-month low in October while employment costs unexpectedly accelerated in the third quarter — underscoring a strong labor market that risks keeping inflation above the Fed’s target.

ADVERTISEMENT

CONTINUE READING BELOW

Aside from the highly anticipated Fed decision, bond dealers are expecting the Treasury to unveil another round of increases this week to its note and bond auctions, though a sizable minority forecast the department will slow the pace of growth to avoid jolting yields higher.

“The main concern on parts of the bond market, particularly the traditional part, is really about the premium you’re getting — the term premium — to go out on the curve,” Russ Koesterich, global allocation fund portfolio manager at BlackRock, told Bloomberg Television. “And that is as much to do with the supply and changing demand dynamics as it does about inflation and the Fed. So you still want to be cautious on long-duration bonds.”

Investors are also looking to guidance from the ongoing earnings season to assess the outlook for profits and how companies are able to withstand headwinds like higher rates. US stocks slumped in October as disappointing showings from technology giants including Google parent Alphabet Inc. and Facebook owner Meta Platforms Inc. have weighed on sentiment.

In other markets, oil advanced after slumping in the first two days of the week, as a still-contained Israel-Hamas war shifted attention to global demand. New Zealand’s dollar fell after disappointing jobs data.

Key events this week:

- UK S&P Global / CIPS UK Manufacturing PMI, Wednesday

- US construction spending, ISM Manufacturing, job openings, light vehicle sales, Wednesday

- All Saints holiday in much of Europe, Wednesday

- Treasury quarterly refunding announcement, Wednesday

- Federal Reserve interest rate decision. Fed Chair Jerome Powell holds news conference, Wednesday

- Eurozone S&P Global Eurozone Manufacturing PMI, Thursday

- Bank of England interest rate decision. Governor Andrew Bailey holds news conference, Thursday

- US factory orders, initial jobless claims, productivity, Thursday

- Apple earnings, Thursday

- China Caixin services PMI, Friday

- Eurozone unemployment, Friday

- US unemployment, nonfarm payrolls, Friday

- Canada employment report, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.2% as of 1pm Tokyo time. The S&P 500 rose 0.7%

- Nasdaq 100 futures fell 0.1%. The Nasdaq 100 rose 0.5%

- Japan’s Topix rose 2.2%

- Australia’s S&P/ASX 200 rose 0.7%

- Hong Kong’s Hang Seng was little changed

- The Shanghai Composite rose 0.2%

- Euro Stoxx 50 futures rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0570

- The Japanese yen rose 0.2% to 151.32 per dollar

- The offshore yuan was little changed at 7.3351 per dollar

- The Australian dollar was little changed at $0.6335

Cryptocurrencies

- Bitcoin fell 0.6% to $34,442.26

- Ether fell 0.2% to $1,810.59

Bonds

- The yield on 10-year Treasuries declined two basis points to 4.91%

- Australia’s 10-year yield advanced three basis points to 4.95%

Commodities

- West Texas Intermediate crude rose 0.1% to $81.12 a barrel

- Spot gold fell 0.3% to $1 977.04 an ounce

© 2023 Bloomberg