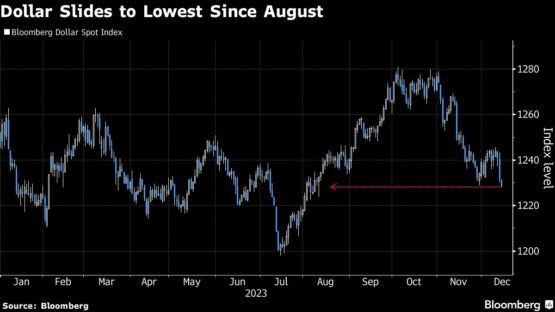

The dollar dropped to a four-month low Thursday as traders digested the clearest signal yet that the Federal Reserve’s aggressive hiking campaign is over.

The Bloomberg Dollar Spot Index dropped as much as 0.3% to its lowest since August, extending losses from Wednesday after Fed officials penciled in a sharper pace of rate cuts than they had seen in September. The US central bank kept rates steady for a third consecutive time.

ADVERTISEMENT

CONTINUE READING BELOW

While Chair Jerome Powell indicated they are still prepared to hike again if price pressures return, Fed officials have pretty much signaled the end of the tightening cycle. Policymakers are now turning their focus to when to start cutting rates as inflation continues its descent toward their 2% goal, Powell said.

“The decisive Fed pivot to rate cuts has pretty comprehensively undercut near-term US dollar prospects,” Richard Franulovich, head of FX strategy at Westpac Banking Corp in Sydney, wrote in a note to clients. “While the door is now wide open to the long awaited big turn in the dollar we still think it is going to take time to develop.”

So-called group-of-10 currencies all advanced versus the greenback on Thursday, with the Australian dollar and the yen both rallying more than 1%. Asian currencies rose across the broad, with the Korean won and Thai baht climbing 2%.

The dollar is on track for its second-consecutive monthly loss after notching its biggest monthly drop in a year in November — a decline of about 3%. The currency’s path will depend on the speed of rate reductions telegraphed by other major central banks as the fight against inflation is weighed against economic fragility.

ADVERTISEMENT

CONTINUE READING BELOW

Investors will soon focus on the upcoming Bank of England and European Central Bank meetings due later Thursday which will help determine whether the dollar selloff will be sustainable. Former ECB President Jean-Claude Trichet said Wednesday that stubborn underlying US inflation means the Fed will likely cut rates after its European peer.

“One way FX moves post Fed might be little exaggerated as liquidity is much lower into year-end, but it also really depends if the ECB out-doves the Fed today or not,” said Mahjabeen Zaman, head of FX research at Australia & New Zealand Banking Group in Sydney. “Going ahead it is really going to be how much the gap between Fed expectations and market expectations narrows or widens that will be a determining factor for how much weaker the dollar goes.”

© 2023 Bloomberg