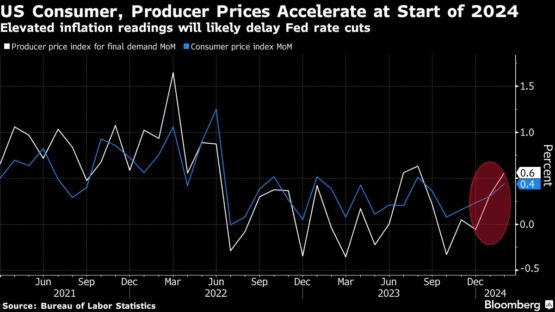

Fresh data on inflation and unemployment filings gave Federal Reserve officials more reasons to hold off on cutting interest rates, even as retail sales suggested a slowdown in consumer spending.

Prices paid to US producers topped forecasts in February, and fewer people applied for and received jobless benefits than previously thought, according to separate reports Thursday. That followed data earlier in the week that showed underlying consumer prices also rose at a brisk pace last month.

ADVERTISEMENT

CONTINUE READING BELOW

While another release indicated a weaker start to the year in consumer spending, the strength in the inflation and labor data support policymakers’ view that they need to see more progress before lowering borrowing costs. Fed officials, who have a dual mandate to maintain price stability and maximum employment, are widely expected to leave rates unchanged at a two-decade high for a fifth month at next week’s meeting.

“When the Fed is contemplating a series of rate cuts and is confronted by suddenly slower economic growth and suddenly brisker inflation, they will respond to the new news on the inflation side every time,” Chris Low and Mark Streiber of FHN Financial said in a note. “As long as wholesale inflation has stabilized or shifts higher and retail inflationary pressures continue, the Fed pause will stretch on.”

Inflation has largely been retreating for the past year or so, driven especially by falling prices for goods and energy. But the latest consumer and producer price indexes from the Bureau of Labor Statistics suggest that progress that is stalling, or possibly even reversing.

So-called core consumer goods prices — which exclude food and energy — rose for the first time since May, while a similar measure at the wholesale level posted the biggest back-to-back increase in a year. Rising energy costs were a major factor in the outsize readings in both the headline CPI and PPI, which came in above forecast in January as well.

Prices of used cars and clothing both increased last month after falling in January.

Key components from the CPI and PPI readings that are used to calculate the personal consumption expenditures price index — the Fed’s preferred inflation metric — suggest the February PCE will come in strong again when released later this month, following a robust January print.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, sees the core PCE advancing 0.4% when rounded, which would roughly equal January’s print. Other forecasters, including those at Barclays Plc and Bank of America Corp., see the February number softening a bit to around 0.3% — which would still mark the strongest consecutive increase in a year.

Shepherdson pushed his forecast for a rate cut to June on the back of the PPI report. Treasury yields popped and the dollar strengthened after the data, while the S&P 500 fell as traders bet on rates staying higher for longer.

Economists at Nomura Holdings Inc. have also pulled back on bets for cuts this year, seeing the first reduction in July and a second in December, versus an earlier call for three cuts starting in June.

For his part, Stephen Stanley, chief US economist at Santander US Capital Markets LLC, anticipates the Fed will keep rates unchanged for much longer than other economists — until November.

“Six weeks ago, the FOMC was seeking ‘greater confidence’ that inflation was moving back to 2% and since then, we have gotten nothing but bad news on the inflation front,” Stanley said in a note, referring to the Federal Open Market Committee, which sets monetary policy.

ADVERTISEMENT

CONTINUE READING BELOW

The Fed will also likely be inclined to stay on pause for longer given the strength of the labor market. Applications for US unemployment insurance were lower than initially reported over the last year after revisions, notably for people already receiving benefits.

A proxy for those people, known as continuing claims, was revised down significantly at the end of February, as well as at the tail end of 2023. Initial jobless claims were also marked down, but not by as much, according to Labor Department data.

What Bloomberg Economics Says…

“February’s retail sales demonstrate that spending momentum is fading, particularly in the services sector. The data broadly align with our assessment of the consumption growth outlook — which is that the brisk pace of spending is largely behind us and a slower period of growth lies ahead.”

— Estelle Ou.

While the recent strength in inflation and jobs data have fed a narrative that the economy is reaccelerating, the retail sales data push back on that idea. The value of retail purchases, unadjusted for inflation, rose by less than forecast in February after downward revisions to the prior two months.

So-called control-group sales — which are used to calculate gross domestic product — were unchanged in February after falling in the prior month. The measure — which excludes food services, auto dealers, building materials stores and gasoline stations — suggests weaker economic activity so far in the first quarter.

“The retail sales report this month supports our view that the economy is strong but cooling,” Morgan Stanley economists led by Ellen Zentner said in a report. “There is no reason for the Fed to rush the next move in rates.”

© 2024 Bloomberg