For September, motorists could find themselves paying between R24.00 and R24.48 per litre of petrol, while wholesale diesel prices may jump to between R23.06 and R23.28 per litre.

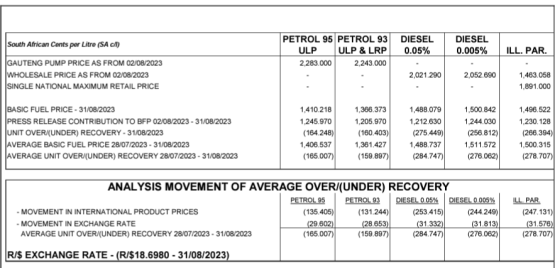

CEF’s fuel price data for the last day of August indicates a substantial under-recovery of between R1.59 and R1.65 per litre for petrol, while diesel saw an even larger under-recovery of between R2.76 and R2.84 per litre.

ADVERTISEMENT

CONTINUE READING BELOW

Although such data fluctuates throughout the month, the anticipated change in the basic fuel price becomes more of a reality closer to the first Wednesday of the new month when the Department of Mineral Resources and Energy announces the revised prices.

Source: Central Energy Fund petrol price data

Upward pressure on fuel price

ADVERTISEMENT

CONTINUE READING BELOW

Movements in international oil prices play a significant role in steering the local fuel price. This month, oil prices have fluctuated between various extremes of under-recovery.

The latest data from the CEF shows that oil prices accounted for between R1.32 and R1.35 per litre of the under-recovery in petrol prices and R2.44 and R2.53 of that in diesel.

Read: Oil rises after industry report points to massive inventory draw

In a note issued earlier this week, FNB senior economist Koketso Mano confirmed that fuel price hikes are likely next week as August brought a weaker rand and higher oil prices.

Looking at the oil markets, we regard them to remain tight, supported by the cumulative [outputs] and falling inventories, but we also think there are still demand side issues. China’s recovery remains lethargic and subject to meaningful state support; meanwhile, the Fed remains hawkish as it asserts that the fight against inflation is not over, so rates in that economy are likely to remain restricted in the near term.

Price of Brent crude over six months

“This suggests that while tighter supply has supported prices, demand headwinds prevail, capping price increases. Also, additional supply could enter the market from producers such as Iran and Venezuela, potentially relaxing supply concerns,” Mano says.

Read: Interest rates are choking middle-class South Africans