After a measly 3% gain in equities in 2023, local is lekker seems to be the predominant theme among fund managers, according to the latest Bank of America (BofA) fund manager survey.

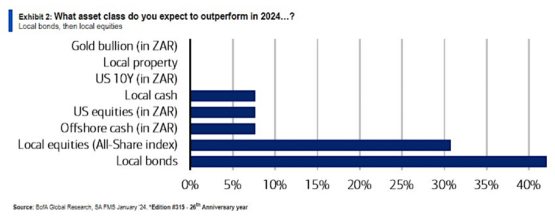

Local bonds in particular are expected to outperform in 2024 as global interest rates are predicted to trend lower, starting from the second quarter. Also favoured are local equities, which stand to benefit from falling interest rates in SA, which will feed through to improved consumer spending over time.

ADVERTISEMENT

CONTINUE READING BELOW

Fund managers expect the rand to strengthen to around R17.73 to the US dollar, a more than 5% improvement on the current rate.

The rand got off to a weak start to 2024, touching R19.21 to the dollar this week, before recovering to R18.80 by Wednesday.

Tatonga Rusike, sub-Saharan economist at BofA Global Research, believes the SA economy should achieve GDP growth of about 1.5% in 2024, considerably better than the expected 0.5% for 2023, once the country gets through the budget next month and the elections in May. Any potential shocks to the economy are likely to come in the first half of the year, allowing for a more stable environment to emerge in the second half.

Read: Kganyago sees 2024 elections among top risks for South Africa

SA’s abysmal growth in 2023 was in large part due to structural issues, such as Eskom load shedding and logistics bottlenecks at Transnet. Massive private investment in solar power has reduced the impact of load shedding on the economy, suggesting the worst may be behind us.

There are also signs of improvement in performance at Transnet.

Read: Durban container port making headway in clearing backlog of vessels

SA can expect a 125 basis points (bps) reduction in interest rates in 2024, which compares with the 475bps increase between 2021 and 2023. On the fiscal side, the medium-term budget shows evidence of improving revenue collection, though debt-to-GDP is likely to widen to around 80% before improving over the next few years.

A substantial rerating in local equities is expected on the back of a weaker US dollar and much improved earnings growth in 2024, according to John Morris, SA investment strategist at BofA Global Research.

Source: BofA Global Research

Fund managers expect a soft landing for the economy, with local bonds and equities expected to outperform offshore assets, given the expected weakness in the dollar and falling interest rates.

Local bonds will benefit from rate cuts, particularly for foreign investors taking advantage of SA’s high yield environment. Foreign inflows from the carry trade – where investors borrow in low interest rate countries like Japan to invest in high interest rate countries like SA – should help strengthen the rand.

Foreigners currently own about 25% of SA bonds, down from 40% in previous years, though this figure should rise over the next 12 months.

ADVERTISEMENT

CONTINUE READING BELOW

Sectors likely to perform well are banks, particularly if interest rate cuts are delayed, and retailers and food producers, which stand to benefit from reduced interest rates over the next two years.

The impact on retailers is likely to be delayed, as it takes time for lower interest rates to filter through to consumer spending.

Don’t expect too much excitement out of China, says BofA, which is likely to grow 4.7% this year. While impressive by world standards, this is well short of historical Chinese growth rates and insufficient to inject massive stimulus into the global economy.

Energy prices are likely to remain stable, though geopolitical risks such as those playing out in the Red Sea could push energy prices higher.

Read: Suez Canal and investment rationale

Pension funds have been sellers of local bonds, and are on average about 32% invested offshore, up from previous levels at 25%. Their appetite for offshore investment remains strong.

The danger of SA falling into a debt trap – where interest payments on debt gobble up an unsustainable percentage of the budget – are likely to be averted over a three-year horizon, particularly as Eskom requires less financial support from the state.

The first half of 2024 is likely to be choppy, with SA elections due in May.

The US elections in November this year are another potential speed bump that could lead to a more cautious approach to emerging markets. A Donald Trump victory in those elections could, however, be positive for emerging markets, as they were in 2017 during the first year of his presidency.