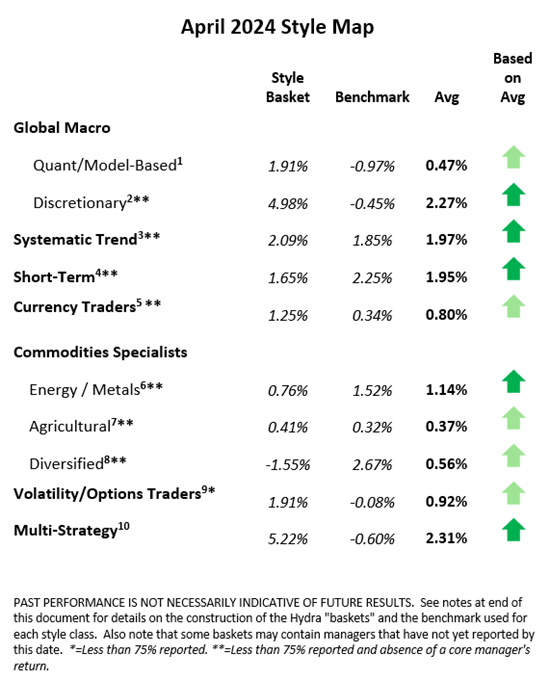

The Style Heat Map below offers a snapshot for the month on all categories of strategies. For the month of April, the following summaries highlight six of the 10 style categories that we track.

Global Macro – Discretionary

Discretionary global macro managers generally performed well in April. Those programs that generated outsized gains appeared to have done so in commodities (e.g .long gold and copper) and currencies (e.g.long US dollar and short Japanese Yen). Most programs were modestly positive in a more balanced manner across fixed income, FX, and commodities. In fixed income, traders caught the rising yields move on the Fed’s hawkish “higher for longer” tone, while a few others adhered to a longer-term “curve steepening” trade. Short Japanese yen versus USD-British pound-euro was another popular trade as the yen suffered weakness throughout the month. In commodities, in addition to the metal trades above, a few programs closed out long softs positions (e.g. cocoa and coffee) at a profit.

Systematic Trend Programs

Long term trend followers had another profitable month making 2024 very successful so far. Even though April posed a pivotal shift in sentiment reversing a multi-month rally in equities causing this sector to be the only loser overall, most programs did well to be short fixed income (US, Europe) as yields rose on the Fed’s relatively hawkish stance with signaling fewer rate cuts later this year. Accordingly, the prospect of higher interest rates in the US made the US dollar more attractive versus all other currencies, especially the Japanese yen, making FX a profitable contributor for trend followers. Commodities also reacted to the news in rates, with gold rallying strongly to all-time highs mid-month, with base metals such as copper and iron ore also rallying. Longer-term trend programs slightly outperformed their medium-term and short-term counterparts.

Short-Term Programs

We very rarely comment on our short-term style bucket due to the lack of uniformity and consistency amount programs, meaning returns are typically dispersed across the board. But April proved to be generally positive among all programs – making it easier to draw generalizations. As with their long-term systematic cousins, systematic short-term programs suffered in equities in choppy trading as markets sold off, spinning models around unprofitably. Fixed income and rates, in contrast, were rather consistently good and the leading sector across programs taking short positions across the US yield curve as yields rose. FX also performed well capturing the strong US dollar versus most G10 and emerging currencies, particularly in short Japanese yen versus USD-British pound-euro. And in commodities, most programs appeared to capture the strong rally in gold. Momentum models clearly outperformed non-directional and fundamentally/discretion-based short term models.

Commodities Specialists – Agricultural Markets

Fundamentals-based, discretionary grains traders underperformed in April on short-term rallies that pushed their longer-term bearish picture for corn and soybeans into risk stops. The longer view (3-12 months) sees plentiful global supplies and a glut of soymeal versus reduced animals on feed globally. Meal is primarily used to feed animal stocks. During April, however, short-to-intermediate weather and supply-side factors in North and South America rallied markets (at times sharply) and made week-to-week trading and positioning very tricky. The short-term fundamentals become especially pronounced in the front of the curve (short-dated contracts), pushing spread trades into risk stops and locking in losses as positions must be reduced or exited. A few programs more weighted towards livestock markets did well trading cattle on short-term weakness, while those programs trading softs such as cocoa, coffee and cotton generally did well to close out long exposures and capturing profits into month-end.

Commodities Specialists – Industrial Markets (Metals/Energies)

Directional and long-biased discretionary metals programs were generally profitable in April. Gold, especially, rallied on inflation concerns, escalating geopolitical concerns, and heavy retail buying in China all acting to move gold to multiple all-time highs. Meanwhile, April saw demand-driven double-digit percentage gains for most industrial metals, especially copper, nickel and zinc. Discretionary energy programs also did well, whether focused on natural gas or crude and refined products. Nat gas mostly moved sideways all month making positive returns impressive, primarily by properly positioning spread trades on mild weather in the US. Discretionary oil traders were short crude and products for predictable seasonal rather than structural reasons. When directional systematic programs sold out of their long positions and began building short positions, prices declined further, making for attractive long entry points for fundamental traders.

FX Specialists

Systematic FX programs performed well in April, outperforming their more discretionary and fundamental peers. Momentum models did well to stay short the Japanese yen versus the US dollar, British Pound and Euro, ignoring the many pronouncements out of Japan to defend the Yen against further weakness. Although the yen did eventually rally back from 34-year lows against USD, discretionary traders expected the yen to rally earlier, and therefore tended to close out positions before profits were realized.

**********

Kettera Strategies

Footnotes

For the “style classes” and “baskets” presented in this letter: The “style baskets” referenced above were created by Kettera for research purposes to track the category and are classifications drawn by Kettera Strategies in their review of programs on and for the Hydra Platform. The arrows represent the style basket’s overall performance for the month (e.g. the sideways arrow indicates that the basket was largely flat overall, a solid red down arrow indicates the basket (on average) was largely negative compared to most months, etc.). The “style basket” for a class is created from monthly returns (net of fees) of programs that are either: programs currently or formerly on Hydra; or under review with an expectation of being added to Hydra. The weighting of a program in a basket depends upon into which of these three groups the program falls. Style baskets are not investible products or index products being offered to investors. They are meant purely for analysis and comparison purposes. These also were not created to stimulate interest in any underlying or associated program. Nonetheless, as these research tools may be regarded to be “hypothetical” combinations of managers, hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any product or account will achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Benchmark sources:

- Blend of Eurekahedge Macro Hedge Fund Index and BarclayHedge Global Macro Index

- The Eurekahedge Macro Index (same link as above)

- The Societe Generale Trend Index

- The Societe Generale Short-term Traders Index (same link as above)

- The BarclayHedge Currency Traders Index

- Blend of Bridge Alternatives Commodity Hedge Fund Index and BarclayHedge Discretionary Traders Index

- The BarclayHedge Agricultural Traders Index

- The Eurekahedge Commodity Hedge Fund Index:

- Blend of CBOE Eurekahedge Relative Value Volatility Hedge Fund Index and CBOE Eurekahedge Long Volatility Index:

- Blend of Eurekahedge Asset Weighted Multi Strategy Asset Weighted Index and BarclayHedge Multi Strategy Index

Indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends and do not reflect the impact of advisory fees. Index data is reported as of date of publication and may be a month-to-date estimate if all underlying components have not yet reported. The index providers may update their reported performance from time to time. Kettera disclaims any obligation to verify these numbers or to update or revise the performance numbers.

***

The views expressed in this article are those of the author and do not necessarily reflect the views of AlphaWeek or its publisher, The Sortino Group