Exporters in South Africa and other countries in the region are increasingly avoiding South Africa’s dismal rail and harbour logistics in favour of alternative routes to ensure their products reach markets timeously and efficiently, according to experts.

On 2 January the first copper from the Kamoa-Kakula copper fields in the Democratic Republic of Congo (DRC) arrived in Angola’s Lobito harbour via the new Lobito Atlantic Railway corridor, while Mozambique’s Maputo harbour reported record cargo volumes, mostly South African minerals.

ADVERTISEMENT

CONTINUE READING BELOW

The copper exports arrived in Lobito within eight days, compared to the 25 days it usually takes to be trucked to Durban.

The Invanhoe mining group says the line passes within five kilometres of the Kamoa-Kakula Copper Complex licence boundary and through its Western Foreland Exploration Project. Logistics costs constitute almost a third of the mine’s cash costs and the new rail corridor will reduce not only the costs, but also the carbon emissions considerably.

Source: www.invanhoemines.com

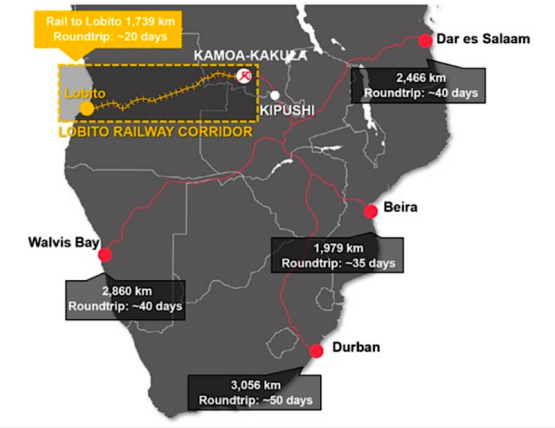

The railway line stretches 1 289km from Lobito to the town of Luau on the Angolan border with the DRC, and then a further 450km to Kolwezi in the DRC.

Additional benefits

The first shipment of 1 110 tons of copper concentrate is part of a trial tonnage of 10 000 tons that will allow the group to gather information on greenhouse gas savings, transit times, operating costs and other factors.

The mine currently exports 90% of its copper concentrate using road transport to the harbours of Durban in South Africa and Dar es Salaam in Tanzania. Smaller volumes go through Beira in Mozambique and Walvis Bay in Namibia.

The distance to Lobito is about half that to Durban, and rail transport is faster and less energy-intensive.

The Angolan part of the railway line was developed by a private consortium in terms of a concession agreement with the Angolan government. About $450 million was invested in the project and the consortium is supplying more than 1 500 wagons and 35 locomotives. A further $100 million was invested to upgrade the line on the DRC side.

Professor Jan Havenga, transport economist at the University of Stellenbosch, says the plans for the railway line have been on the table for a long time. It is quite possible that the Angolan and DRC governments have expedited its execution in light of the logistics crisis in South Africa.

Hugo Pienaar, chief economist of Minerals Council SA, says South Africa’s neighbours are not sitting back doing nothing.

“We cannot assume that we can continue to mess up and they will continue to use our export routes.”

He points out that exports from the DRC through the Port of Durban also require navigating several border posts. “That is a nightmare!” he says.

“They probably made the calculations and established that they will be able to recover the money [invested in the project] through savings in time, money and emissions.”

Impact on SA

Mike Walwyn, who chairs the Cape Town Chamber of Commerce harbour liaison forum and has about 40 years of experience in the logistics industry, estimates that copper exports from neighbouring countries constitute about 5% of all exports through Durban.

He says that in itself is not such a big loss, but neighbouring countries are increasingly seeking alternatives due to the inefficiency of South African rail and harbour operations.

ADVERTISEMENT

CONTINUE READING BELOW

“Earlier all DRC copper exports went through Durban, but it has already started shifting to Dar es Salaam and Beira,” he says, adding that manganese and chrome that used to be exported through Richards Bay is increasingly going through Maputo.

He agrees that the Lobito corridor would have been built at some stage and that frustration regarding exports through South Africa has probably resulted in the plans being executed now.

“Remember, copper is non-perishable and therefore less sensitive to delays than fresh produce,” says Walwyn.

Citrus producers along the Orange River are increasingly using the Walvis Bay harbour for exports instead of Cape Town, despite the increased distance, because a week’s delay can be catastrophic for them.

Read: Red Sea unrest is bad news for world’s fragile food supply

According to Havenga the copper exports from the DRC are relatively small in volume.

“Our railway and harbours don’t need it. As it is currently being trucked to Durban, the road freight industry created the necessary capacity and that will be redundant if it is exported through Lobito in future.”

He says the road freight industry is however also asking for a turnaround in the rail service. There are currently many “fly by nights” trying to capitalise on the poor state of rail and they are giving the road freight industry a bad name, he says.

Havenga believes the Transnet rail service has reached a turning point – there was already a big improvement in the second half of 2023 – but argues that the development of east-west corridors in Africa is a positive move.

“Sub-Saharan Africa’s logistic system is not configured correctly. The colonial forces wanted everything to go through the southern tip, because that is where they had a presence.”

He says Lobito will in future be linked with the Port of Nacala, where the Mozambican government has built a big harbour, and more east-west corridors are coming. These will be much more efficient than the current north-south routes, he says.

Havenga says South Africa must focus on the recovery of its rail system, especially with regards to exports of coal through Richards Bay, iron ore through Saldanha, manganese through Gqeberha, among others, and the logistics route between Gauteng and Durban.

Read: Transnet taps Vopak as preferred bidder for Richards Bay LNG terminal