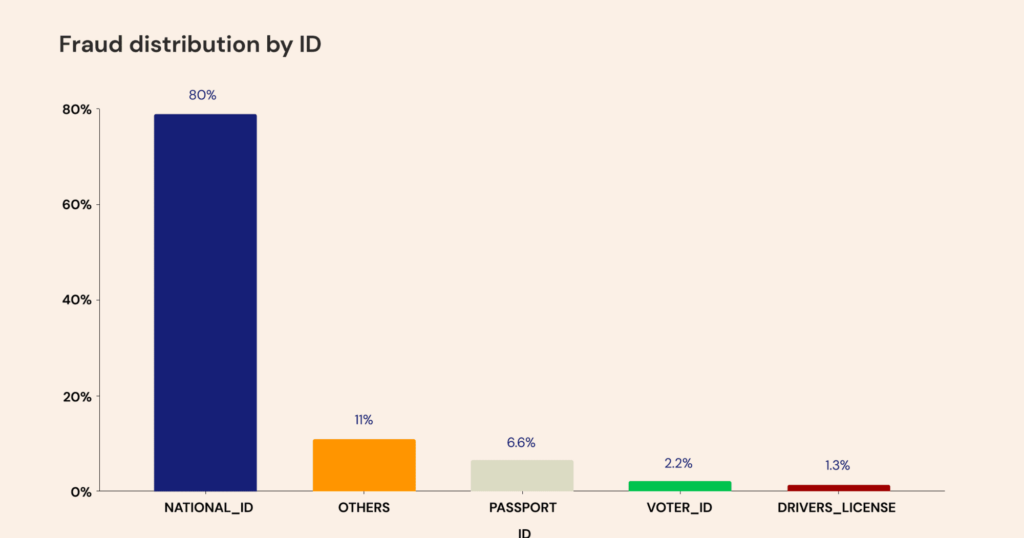

Identity fraud is one of the fiercest sieges accompanying the rise of digital technology. Yet many African countries seem to have their guard down against it. In the last two years, National ID cards suffered 80% of all document fraud attacks in Africa, according to Smile Identity.

Smile Identity provides digital identity verification, fraud detection, anti-money laundering, and KYC compliance solutions to African businesses. Since the company was founded in 2017, it has done over 100 million checks. It used the data from these checks to draw insights into fraudulent verification attempts on the continent. And what it found was a consistent yearly rise in digital identity fraud since 2019.

The report explained that national IDs were the preferred option for bad actors because they were the most widely used form of government identification in most African countries. So, they are the most likely to get lost or stolen. Also, 12 out of the top 20 most attacked document types were National IDs. And Kenya’s ID card is the most vulnerable at a 25% fraud rate.

Meanwhile, South Africa (38%), Tanzania (32%), Kenya (26%), and Uganda(25%) were the hotspots for fraud attacks on national ID cards in Africa. Nigeria ranked ninth with a fraud attempt rate of 18%.

Of the four regions — East Africa, West Africa, Central Africa, and Southern Africa — compared in the report, Central and East Africa saw the highest rate of identity fraud in 2023. Both regions reached a peak of 29% and 30% respectively. Southern Africa peaked at 23%, while West Africa had the lowest fraud rate, peaking at 20%.

Another notable trend is that fraudulent activities increased around 6 p.m. and peaked at 9 p.m. Fraudsters were also more active on Mondays and Wednesdays.

In 2022, the financial industry also saw the highest fraud rates among all sectors. The buy now pay later (BNPL) sub-sector saw the highest rate of biometric fraud, even more than crypto. While this fact may seem surprising, some reports have shown that usage and investment in BNPL startups boomed in 2022.

However, payment platforms took the top spot for the most fraud attempts in 2023, reaching a peak of 43% in January. Notable examples are Flutterwave, which reportedly suffered a ₦2.9 billion hack and Interswitch, which lost ₦30 billion to chargeback fraud. Patricia also lost $2 million to a breach. Savings and investment platforms had the second-highest rate at 24% in October.

Concerning curbing this problem, Smile ID’s report focused on biometric and document verifications. It found that businesses that “rely on textual verification are four times more likely to be breached by fraudulent actors than their counterparts that rely on biometric authentication.”