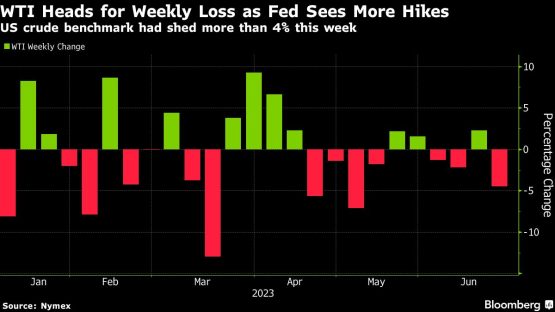

Oil headed for a weekly loss of over 4% after the Federal Reserve signaled that further rate hikes were needed, bruising appetite for risk, aiding the dollar, and raising the prospect of an economic slowdown.

West Texas Intermediate fell below $69 a barrel after tumbling 4.2% on Thursday. In testimony this week, Fed Chair Jerome Powell signaled further monetary tightening was likely in the second half. That’s lifted the greenback, dimming the allure of commodities priced in the US currency.

In Asia, traders have been trying to gauge prospects for demand in China, the world’s largest crude importer. While Beijing has rolled out some stimulus to aid growth, there’s concern the moves so far may not be enough.

Oil is set for a back-to-back quarterly loss as the Fed has lifted rates and traders fret about demand. The drop has come despite production cuts from the Organisation of Petroleum Exporting Countries and its allies. At present, key metrics including WTI’s prompt spread indicate ample near-term supply.

Crude’s drop this week has come despite some positive signals. In the US, total oil product supplied — a proxy for demand — is at the highest since December, while jet fuel consumption on a four-week average was the highest since last summer. In addition, nationwide crude stockpiles fell.

“The oil market remains torn between supportive fundamentals and an uncertain macro outlook,” said Warren Patterson, head of commodities strategy at ING Groep NV. A more hawkish Fed will likely cap the market in the short term but the outlook for the second half is “constructive,” he added.

| Prices: |

|---|

|

© 2023 Bloomberg