Load shedding, floods in KwaZulu-Natal, rising inflation, and a stronger Dollar have all played their part in pushing the Rand back above R16.00 versus the Dollar in recent sessions

The rand held its ground against the dollar in afternoon trade on Tuesday (3 May), having given up 3.6% over last week, trading at R15.99 relative to the greenback – near its weakest levels in nearly five months.

The rand held its ground against the dollar in afternoon trade on Tuesday (3 May), having given up 3.6% over last week, trading at R15.99 relative to the greenback – near its weakest levels in nearly five months.

Load shedding, floods in KwaZulu-Natal, rising inflation, and a stronger dollar have all played their part in pushing the rand back above R16.00 versus the dollar in recent sessions, before Tuesday’s slight recovery.

“The local unit has come under significant pressure, exacerbated by a lack of liquidity during the session yesterday, which saw it relinquish all of the previous session’s gains and more,” said Nedbank in a research note.

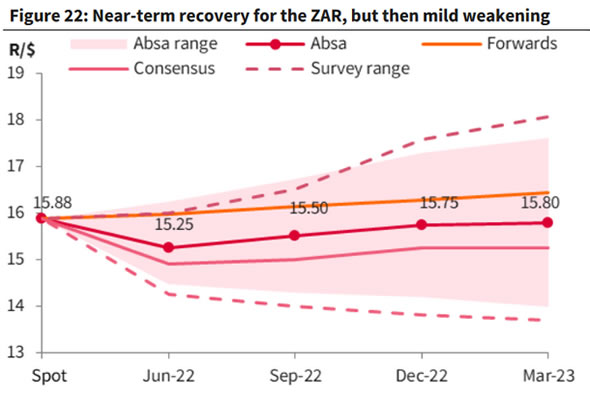

Absa noted that while the rand has weakened sharply in recent weeks, “we believe it is currently undervalued. With the current account set to remain in surplus this year, we expect the rand to recover to R15.25/USD by mid-year before weakening gradually to R15.75/USD by year-end.

In afternoon trade on Tuesday, it traded at the following levels against the major currencies:

- Dollar/Rand: R15.93 (0.81%)

- Pound/Rand: R19.99 (0.59%)

- Euro/Rand: R16.82 (0.86%)

Absa noted that the rand strengthened to a five-month high of R14.47/USD at the end of March. In the run-up to February’s Budget, the exchange rate benefited from strong bond inflows, but towards the end of Q1 22, trade and equity inflows dominated.

“Since the beginning of this quarter, however, the rand has weakened sharply on the back of more hawkish US policy rate expectations, softer commodity prices, a renewed bout of load shedding, devastating floods in KwaZulu-Natal and a sizeable foreign disinvestment from South Africa’s banking sector,” the lender said.

“Our valuation models imply that the rand is now undervalued, and we expect it to recover somewhat to R15.25/USD by mid-year (previously R14.75/USD), but then to weaken gradually to R15.75/USD by year-end. A more aggressive Fed hiking cycle will serve to strengthen the dollar generally.”

Absa said that lower growth in the US and China could also weigh on global commodity prices, which could erode South Africa’s strong terms of trade, leading to a narrower current account surplus over the coming quarters.

“A further risk to the rand is the recent increase in South Africa’s offshore investment limits, which could lead to more capital outflows over time,” it said.

On Wednesday, the Federal Reserve, the central banking system of the United States, is expected to announce its largest interest rate hike since 2000, while various other central banks are also due to release their interest rate decisions later in the week, said Bianca Botes, director at Citadel Global.

“Monetary tightening decisions are currently a balancing act between combatting historically high inflation and not triggering an economic recession,” she said.

Looking ahead, Absa said: “South Africa’s economic recovery from the pandemic has been stronger than expected but a weaker global backdrop and domestic supply shocks are likely to slow the growth momentum. We forecast GDP growth of 2.0% this year and 1.7% next year.”

It said that recent commodity price surges and ongoing supply chain constraints are exerting upward pressure on inflation, which will likely generate second-round effects. “We expect headline CPI inflation to temporarily breach the upper limit of the target range in June, averaging 5.9% in 2022 and 5.4% in 2023.”