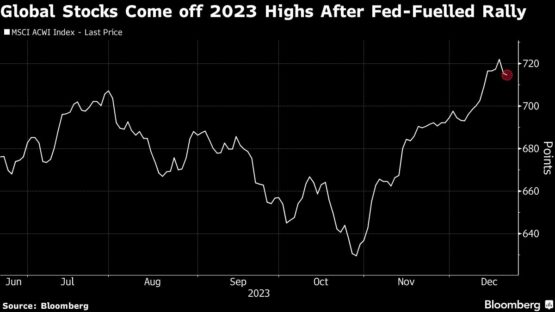

Stocks fell across Asia, following US declines, as optimism over the prospect of Federal Reserve interest-rate cuts waned and investors trimmed holdings before year-end.

The MSCI All Country World Index of shares headed for a second day of loses after it had powered ahead for the previous nine sessions. Both the S&P 500 and Nasdaq 100 stock indexes fell 1.5% on Wednesday. Treasuries traded in a narrow range as did most currencies with volatility easing as the year-end holiday season approaches.

ADVERTISEMENT

CONTINUE READING BELOW

“The dovish tone by the Fed in December has been grossly over exaggerated in terms of its impact on asset prices,” Mark Konyn, chief investment officer at AIA Company Ltd. said on Bloomberg Television. “The market will be little disappointed in terms of when those cuts start to take effect.”

Japanese stocks were among the biggest losers in Asia while technology-heavy markets of South Korea and Taiwan also dropped. Chinese stocks were mixed as mainland shares rebounded after Wednesday’s selloff.

US consumer confidence jumped in December, according to data released Wednesday, suggesting the Federal Reserve need not be in a hurry to cut interest rates. US data due Thursday include third-quarter GDP and weekly initial jobless claims.

Toyota slumps

Toyota Motor Corp shares slid after subsidiary Daihatsu Motor’s offices were raided over a safety scandal and the automaker recalled 1 million cars in the US. The raid came after revelations the carmaker and supplier manipulated the results of collision safety tests dating as far back as 1989.

Citigroup Inc. decided to exit the distressed-debt trading business, according to people briefed on the matter. Morgan Stanley, meanwhile, considered allocating a portion of its balance sheet to a new private credit fund, according to people with knowledge of the plans. FedEx Corp., a bellwether for the US economy, reported diminished profits, heightening concerns about a slump.

In commodities, oil fell toward $74 per barrel, trimming a gain from Wednesday, while gold steadied after falling Wednesday to trade close to $2,030 per ounce.

ADVERTISEMENT

CONTINUE READING BELOW

Bitcoin edged higher, building on Wednesday’s gains with the Securities and Exchange Commission facing a Jan. 10 deadline to reject or approve ETFs. The token rose as high as $44,294 on Wednesday.

Friday looks potentially busy with data releases including UK GDP, US consumer sentiment and so-called core personal-consumption expenditures price index — the Fed’s preferred inflation gauge.

Key events this week:

- Bank Indonesia rate decision, Thursday

- US GDP, initial jobless claims, Conf. Board leading index, Thursday

- Nike earnings, Thursday

- Japan inflation, Friday

- UK GDP, Friday

- US personal income and spending, new home sales, durable goods, University of Michigan consumer sentiment index, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 12:07 p.m. Tokyo time. The S&P 500 fell 1.5%

- Nasdaq 100 futures rose 0.3%

- Japan’s Topix fell 1%

- Australia’s S&P/ASX 200 fell 0.4%

- Hong Kong’s Hang Seng fell 0.2%

- The Shanghai Composite rose 0.4%

- Euro Stoxx 50 futures fell 0.6%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro was little changed at $1.0950

- The Japanese yen rose 0.5% to 142.88 per dollar

- The offshore yuan was little changed at 7.1447 per dollar

Cryptocurrencies

- Bitcoin was little changed at $43,438.76

- Ether rose 0.6% to $2,192.8

Bonds

- The yield on 10-year Treasuries advanced one basis point to 3.86%

- Australia’s 10-year yield declined three basis points to 4.02%

Commodities

- West Texas Intermediate crude fell 0.3% to $73.98 a barrel

- Spot gold rose 0.3% to $2 037.15 an ounce

© 2023 Bloomberg