Western firms in China are the gloomiest they’ve been about the outlook for business and want Beijing to do more to reassure foreign investors as geopolitical tensions and economic woes dent sentiment.

That’s according to a pair of business chamber reports published Tuesday gauging views among American and European companies operating in the world’s second-largest economy. The releases found that optimism among some firms about China is at record lows, and that authorities aren’t doing enough to make good on promises to facilitate or encourage foreign companies in China.

ADVERTISEMENT

CONTINUE READING BELOW

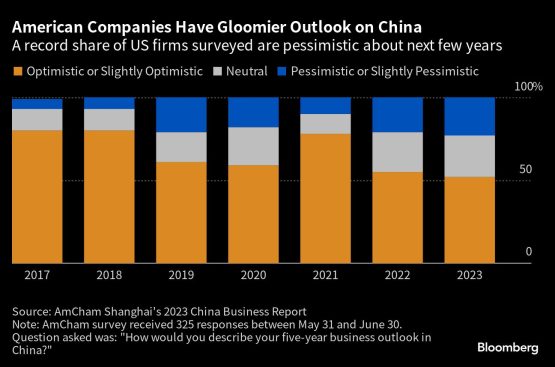

“Concerns about geopolitics, US-China relations and China’s poor economy are all weighing on expectations,” the American Chamber of Commerce in Shanghai wrote in a report about its survey results, which found just 52% of respondents said they were at least slightly optimistic about the business outlook in China over the next five years. That’s three percentage points less than in 2022 and the lowest since the chamber began surveying members in 1999.

Foreign companies operating in China have faced challenges this year, even as the country’s top leaders have stressed a commitment to “opening up.” US-China strains, data security rules and concern about Chinese actions targeting American and other overseas firms have rattled companies. American due diligence firm Mintz Group, for example, was fined around $1.5 million last month for illegal data collection, months after officials raided its Beijing offices.

The domestic economy has also been struggling after an early rebound from the end of pandemic curbs faded. There are some early signs that things are stabilizing, but the housing market is still shrinking and business profits are falling.

The flurry of concerns in the past year has dragged on business, with cross-border flows of direct investment into and out of China slipping to a $16.8 billion deficit in August — the worst since early 2016, according to the State Administration of Foreign Exchange.

In a separate report Tuesday, the European Union Chamber of Commerce in China called on Chinese policymakers to tackle the fundamental, structural issues it said are hindering the economic rebound. It also said the government needs to take concrete action to address challenges faced by private companies, whether Chinese or foreign.

“This would do much to rejuvenate business confidence and restore the appetite of foreign companies to continue engaging with China, and even increase their investments,” said Jens Eskelund, the European chamber’s president. He spoke earlier this month ahead of the launch of the chamber’s annual “position paper,” which makes sector-specific suggestions for reform.

The EU chamber’s report criticised the government’s efforts to attract foreign investment this year, saying that while authorities have been keen to talk, they’ve only offered an “old menu” of promises.

“Renaming a list of old dishes will not satisfy the appetite of foreign investors. Instead, China needs to listen to long-standing concerns and take tangible steps to address them,” the report said.

Beijing last month announced a 24-point plan to reverse a slump foreign investment. The EU chamber encouraged those efforts, saying the proposal will help boost business confidence “if implemented in a timely, coordinated and consistent manner.” AmCham Shanghai was also positive about that plan in its report.

The only actionable policy to result so far from that outline, though, has been an extension on preferential income tax policies for foreigners working in the country.

“Now they’ve 23 to go,” Eskelund said. “We hope this time it’s for real.”

US firms

The AmCham survey, which polled more than 300 firms in and around Shanghai in June, painted a troubling picture of the state of US corporate sentiment about China, even after the nation’s pandemic controls were lifted.

ADVERTISEMENT

CONTINUE READING BELOW

US-China relations have been a considerable pain point for American companies. Nearly a fifth of the survey respondents said they’re considering moving some of their current operations out of the world’s second-largest economy over the next few years.

Uncertainty about ties between Washington and Beijing was cited as the No. 1 reason. Those redirecting investment away from China — or who are planning to — cited Southeast Asia, the US and Mexico as potential destinations.

Weaker profits may also make it more difficult for companies to justify the geopolitical risks and regulatory hurdles of going big in China. Only 68% of survey respondents said they were profitable in 2022 — another record low — given the lengthy, widespread Covid-19 controls that hampered operations.

Even after the nation’s reopening, expectations for future profitability are relatively muted. Only 40% of survey respondents expect revenue growth to outpace global growth in the next three-to-five years.

Asked Tuesday about the AmCham survey, Chinese Foreign Ministry spokeswoman Mao Ning told reporters that the nation’s economy “enjoys strong potential, resilience and dynamism, and the sound fundamentals sustaining its long-term growth remain unchanged.”

“We’ve rolled out a lot of measures and to attract foreign investments, which have been widely welcomed by investors and will continue to deepen reform and opening up and welcome foreign businesses to China,” she said at a regular press briefing.

There were some bright spots. About a third of respondents said they plan to increase investment in China this year, up slightly from last year. China’s market growth potential and the end of Covid curbs were the top reasons.

Chinese leaders have also reiterated support for foreign firms in recent days. People’s Bank of China Governor Pan Gongsheng said Monday at a symposium attended by representatives from top foreign companies — including JPMorgan Chase & Co., HSBC Holdings Plc., Deutsche Bank AG, BNP Paribas, UBS Group AG and Tesla Inc. — that the central bank would improve the business environment for overseas firms.

“We’ve seen some really good progress over the last several months in US-China relations,” said Sean Stein, chairman of AmCham Shanghai. He cited the recent visit of US Commerce Secretary Gina Raimondo as an event that’s “putting a floor” under ties.

“That is something potentially could help our optimism and pessimism numbers going forward,” he said, “because that’s the biggest issue.”

© 2023 Bloomberg