South Africa’s rand extended gains on Wednesday, heading for its biggest two-day advance against the dollar since July, as a rally in government bonds lured foreign investors back to the country’s debt.

The rally, sparked on Tuesday by cool US inflation data that raised optimism the Federal Reserve is getting closer to a rates pivot, may extend into the close of the year: The South African currency is more likely to end 2024 below the current level of around R18.16 per dollar than above, according to Bloomberg’s forecast model based on options pricing.

ADVERTISEMENT

CONTINUE READING BELOW

The rand gained 0.4% to R18.15 per dollar by 2:50 p.m. in Johannesburg, bringing gains in the past two sessions to 3.1%.

These four charts show why South Africa’s rand may end the year on a strong note:

Volatility

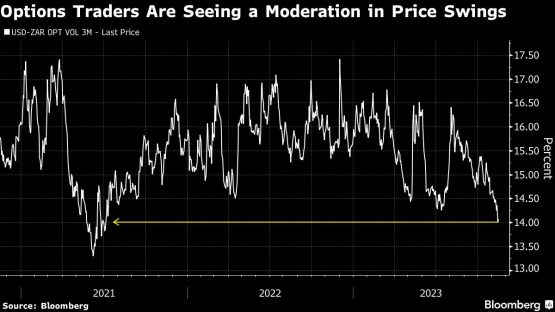

Implied volatility levels are falling, suggesting options traders anticipate price swings to moderate in the coming weeks and months. Three-month implied volatility for the rand versus the dollar is near its lowest level in more than two years.

Risk reversals

The cost of hedging against rand declines is falling. One-month risk reversals — the premium of options to sell the currency over those to buy them — are around a six-month low.

Bond demand

Tuesday saw the strongest demand from local banks at a government bond auction since July 2021, and foreign investors are also returning to the market. Non-residents bought most South African bonds on a net basis on Tuesday in four months, according to JSE. data. Inflows this quarter amount to R17.5 billion ($965 million), according to JSE data tracking settled trades.

ADVERTISEMENT

CONTINUE READING BELOW

Carry trade

Lower volatility and yields among the highest in emerging markets are boosting the rand’s appeal for investors who borrow at low interest rates to invest in assets that provide a higher rate of return, known as the carry trade. The dollar-rand carry trade has returned 4.7% this quarter after losing 8.2% in the first nine months of the year. That’s stoked demand for South African bonds: the Bloomberg EM Local Currency South Africa Bond Index had its biggest daily gain in four months in dollar terms on Tuesday, and is trading near the highest level since July.

© 2023 Bloomberg