Shares in Japan and Australia rose while equities in China retraced an early advance following data that showed a chill in the country’s manufacturing and property sectors, thwarting a run of gains for the region’s equities.

Beyond China, stocks were broadly higher, including in South Korea, where the Kospi benchmark added more than 1%. The gains followed a bullish day on Wall Street and in Europe as investors parsed signs of stability in the global economy. US and European equity futures were little changed.

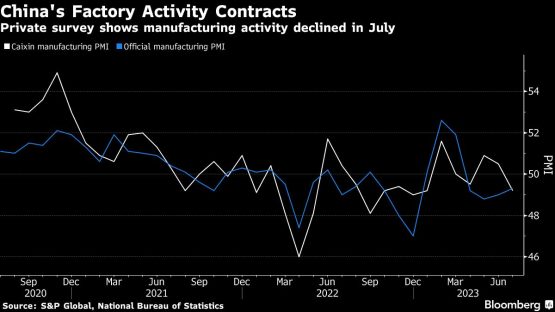

Mainland China and Hong Kong shares inched lower, threatening to end a six-session streak of gains for a gauge of the region’s stocks after Caixin PMI figures showed factory activity contracted in July, missing economists’ estimates for a small expansion.

Meanwhile, home sales plunged by the most in a year last month, underscoring why policymakers need to address faltering demand and a liquidity crunch in the sector. Major developer Country Garden Holdings slid in the equity and credit market after it canceled a share sale, raising concerns over its ability to meet $2.9 billion in bond payments for the rest of the year.

China investors “are still waiting to see some meaningful comeback in high frequency indicators,” Alec Jin, investment director of Asian equities at abrdn, wrote in a note. “We would expect targeted measures that can boost consumer income and demand in sectors like autos, electronics and household products,” as well as more support for the property sector, he added.

The Australian dollar weakened against the greenback after the nation’s central bank held interest rates unchanged. Financial markets had predicted the decision, while economists anticipated a 25 basis point hike. Australian bond yields extended declines following the decision.

Monday gains extended a run of monthly advances for US equity benchmarks. The S&P 500 edged higher to around 4,590, closing at a 16-month high, while the Nasdaq 100 notched its longest streak of monthly gains since August 2020.

The buoyant mood on Wall Street has seen a retreat among bearish institutional investors, economists and strategists as market returns and economic data continue to challenge expectations, said Mark Hackett at Nationwide.

Citigroup Inc.’s Scott Chronert has joined the list of strategists who have revisited their gloomy outlooks in recent weeks, raising his forecast for the S&P 500. Morgan Stanley’s Michael Wilson, who has been among the market’s leading pessimists throughout 2023, changed his tone and now sees the rally running further.

“The challenges companies have endured – stubborn inflation, weak markets, and sluggishness internationally – are no longer headwinds,” Hackett noted. “Now, we’re not only seeing tailwinds heading into 2024, but we’re getting less disruptive reactions in the stock market following earnings reports.”

Treasury 10-year yields traded near 3.95% while the dollar posted a small gain.

Yen weakens

The yen traded weaker against the dollar, adding to Monday’s decline, amid sluggish demand at a 10-year bond auction. While investors had earlier anticipated that the Bank of Japan is moving toward letting yields rise after a tweak to its yield-curve control policy, it bought bonds on Monday to anchor rates.

The tweak to YCC “is great for the Japan equity story,” Gareth Nicholson, chief investment officer and head of discretionary portfolio management for Nomura International Wealth Management said on Bloomberg Television, referring to the yield curve control policy. “You have a measured, controlled policy change, controlled growth and controlled inflation at the moment — these are all things investors like.”

The euro-area economy returned to growth, data showed Monday, while underlying inflation pressures persisted — supporting early arguments for the European Central Bank to raise interest rates again.

In the US, data pointing to inflation becoming tamed boosted optimism the world’s biggest economy will have a soft landing as the Federal Reserve nears the end of its monetary-tightening cycle.

In corporate news, HSBC Holdings Plc announced a new $2 billion share repurchase program, according to an earnings statement that showed pretax profits rose to $8.8 billion in the June quarter, outpacing estimates. Shares in Japanese carmaker Toyota Motor Corp. closed at a record high after it reported ¥1.1 trillion ($7.7 billion) in operating profit for the quarter.

In the US, Exxon Mobil Corp. climbed as Bloomberg News reported it’s in talks with Tesla Inc., Ford Motor Co. and other automakers about supplying them with lithium. SoFi Technologies Inc. surged 20% as the online bank raised its revenue guidance.

Fed survey

Traders took a Federal Reserve survey of lending officers in stride. As hinted by Chair Jerome Powell, the central bank said financial institutions reported tighter standards and continued weak demand for loans in the second quarter, extending a trend that began before recent stresses in the banking sector emerged.

Meantime, Fed Bank of Chicago President Austan Goolsbee said data showing slower inflation is “fabulous news,” but he hasn’t yet decided on whether to support pausing rate hikes at the next policy meeting. Over the weekend, his Minneapolis counterpart Neel Kashkari said the inflation outlook is “quite positive,” though the central bank’s aggressive tightening will likely result in some job losses and slower growth.

Elsewhere, oil edged down after surging 16% in July, its biggest monthly advance since early 2022.

Key events this week:

- Eurozone S&P Global Eurozone Manufacturing PMI, unemployment, Tuesday

- US construction spending, ISM Manufacturing, job openings, light vehicle sales, Tuesday

- China Caixin Services PMI, Thursday

- Eurozone S&P Global Eurozone Services PMI, PPI, Thursday

- Bank of England rate decision, Thursday

- US initial jobless claims, productivity, factory orders, ISM Services, Thursday

- Eurozone retail sales, Friday

- US unemployment rate, non-farm payrolls, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 7:19 a.m. London time. The S&P 500 rose 0.2%

- Nasdaq 100 futures were little changed. The Nasdaq 100 was little changed.

- Australia’s S&P/ASX 200 rose 0.5%

- Hong Kong’s Hang Seng fell 0.9%

- The Shanghai Composite fell 0.3%

- Euro Stoxx 50 futures fell 0.1%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro was little changed at $1.0989

- The Japanese yen fell 0.3% to 142.72 per dollar

- The offshore yuan fell 0.4% to 7.1738 per dollar

- The Australian dollar fell 0.9% to $0.6659

- The British pound was little changed at $1.2825

Cryptocurrencies

- Bitcoin fell 1% to $28,919.61

- Ether fell 1.3% to $1,829.55

Bonds

- The yield on 10-year Treasuries was little changed at 3.95%

- Japan’s 10-year yield was unchanged at 0.595%

- Australia’s 10-year yield declined eight basis points to 3.98%

Commodities

- West Texas Intermediate crude fell 0.4% to $81.47 a barrel

- Spot gold fell 0.4% to $1 956.41 an ounce

© 2023 Bloomberg