The annual meetings of the International Monetary Fund and World Bank kick off this week against a backdrop of escalating global conflict and debt distress.

A new outbreak of violence in Israel and the grinding war in Ukraine add a grim dynamic to the Washington-based lenders’ efforts to rally their members and keep the focus on reforms to bolster their financial firepower.

ADVERTISEMENT

CONTINUE READING BELOW

The gatherings in Marrakech, Morocco — which bring together the world’s finance ministers, central bank governors and top commercial banking executives — are taking place in Africa for the first time in 50 years. Kenya’s capital, Nairobi, was host in 1973, the same year as the Yom Kippur War in the Middle East. Like the current violence, that conflict caught Israel by surprise at a time of global economic fragility.

The confluence of issues, amid high interest rates and a cautious economic outlook, reminds the estimated 10 000 attendees “how quickly geopolitics can change their calculations,” said Josh Lipsky, senior director of the GeoEconomics Center at the Atlantic Council.

Here’s what to watch for this week:

Economic clouds

The global economy has been buffeted by inflation, the steepest monetary tightening in a generation, China’s property crisis and Russia’s invasion of Ukraine, yet expansion keeps chugging along. That has markets rushing to price in a higher-for-longer interest-rate outlook, with 30-year US Treasury bond yields last week punching through 5% for the first time since 2007.

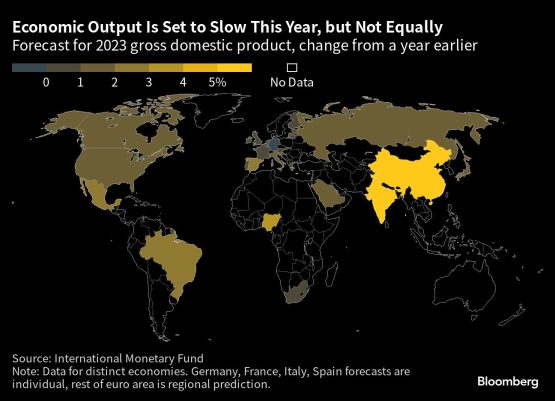

The IMF will gives its forecast and analysis of the risks when it releases an update to the World Economic Outlook on Tuesday morning. At its last update in July, the IMF raised its forecast for global gross domestic product growth to 3% in 2023, up from its April forecast of 2.8%.

Yet many of the risks identified in July have intensified since then, adding uncertainty to whether the projections remains on track. As well, while discussions over monetary policy often overshadow fiscal updates at such multilateral conferences, there may be more attention paid to the outlook for state treasuries this time with many of the world’s largest economies still deeply in the red.

Multilateral dysfunction

One again, conflict risks muddying a coherent message from the Group of 20, which represents more than 80% of the global economy created after the global financial crisis to seek a shared path forward. After a consensus communique was reached at its leader summit in India last month, the upcoming finance ministers and central bank governors will be facing a new challenge of addressing the conflict in Israel while balancing several, often clashing, stances.

That was most visible this week in China, as a US congressional delegation headed by Senate Majority Leader Chuck Schumer criticized Beijing’s response to the fighting as being insufficiently supportive of Israel. At the same time, the US-China tension will be a common theme through the week, as the IMF warns about the economic costs of worsening political fragmentation.

Debt help

The so-called Bretton Woods institutions, along with the G-20, are at the center of an effort to rewrite the global financial playbook around debt distress. Piles of loans in emerging markets taken out during the era of low rates and China’s surge of Belt and Road Initiative lending, have now fallen into distress. But nobody knows yet how to resolve that.

The effort, and its very slow progress, comes into focus Thursday during a session of the Global Sovereign Debt Roundtable, a novel effort to bring together debtor countries along with the so-called Paris Club group of lenders, China and other new lenders, as well as private creditors. Seeking a unified approach to restructuring debt held by such a diverse group has been difficult, and expectations are low for any breakthroughs. Some progress on individual cases may emerge, however, with progress on restructuring agreements expected on Sri Lanka and Zambia.

ADVERTISEMENT

CONTINUE READING BELOW

Bretton Woods reforms

World Bank President Ajay Banga is expected to lay out his vision for the development lender, including efforts that could raise lending by more than $100 billion over the next decade. IMF Managing Director Kristalina Georgieva intends to raise the fund’s so-called quotas, seeking more money from members to help it reclaim its place at the center of the global financial safety net.

Both efforts find their biggest supporters, and obstacles, from the US. Treasury Secretary Janet Yellen spurred on the World Bank’s so-called evolution road map last year, asking the bank to take on a broader set of challenges and rally the private sector.

She’s also called on partners to pony up more guarantees or other types of funding to help strengthening its lending clout. The response as been muted, partly because of a realization that even Yellen’s efforts to bolster the bank must go through Congress, which has been embroiled in fierce disputes over spending. And the US House is leaderless at the moment.

The IMF leadership will discuss the December deadline for its 16th review of quota — the term for the resources that all members pay into the organization and finance its lending. The US favors increasing resources but opposes shifting voting weight, which would give more power to China. Georgieva said this month that she’s interested in expanding the role of emerging and developing countries, including adding a third seat on its executive board to represent Africa. She also supports giving China a bigger vote, but that’s not on the table until the next five-year review period.

Morocco recovery

The “city of cheerfulness,” as Moroccans refer to Marrakech, is still recovering from a devastating earthquake centered in the nearby mountainous region that killed almost 3,000 people.

The meetings find the cash-strapped kingdom in need of $11.7 billion to pay for rebuilding and potentially billions of dollars more to prepare to co-host the FIFA soccer World Cup in 2030.

With about 60 000 people left homeless, concern is growing with the approach of winter over the living conditions faced by survivors. The Red Cross last week called for “urgent humanitarian needs as winter approaches,” including warm shelter, latrines and showers.

© 2023 Bloomberg