Stocks in Asia dropped from session highs as concern over China’s faltering economy dragged down the nation’s equities.

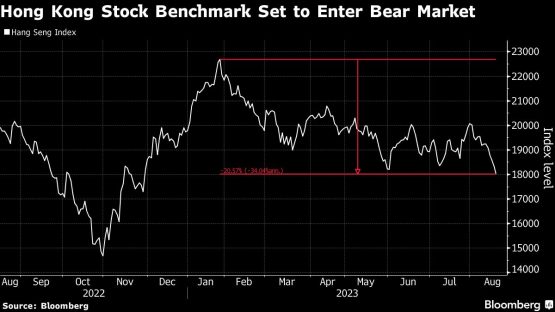

A gauge of regional shares more than halved its earlier advance as benchmark indexes in Hong Kong and China fell. China’s commercial lenders kept their benchmark lending rates unchanged Monday, in line with the central bank’s decision last week to refrain from cutting borrowing costs.

ADVERTISEMENT

CONTINUE READING BELOW

Shares rose in Japan and Taiwan after the S&P 500 climbed to a record Friday for the first time in two years led by the technology sector. US stock futures extended gains in Asia. Oil steadied after an earlier decline as OPEC member Libya restarted production from its largest field, outweighing concerns about Middle East tensions.

China losses may be due “a lack of catalysts in the near term, and outflows due to more attractive alternatives in the region,” said Marvin Chen, an analyst at Bloomberg Intelligence in Hong Kong. “Global markets have been surging on the chip sector, and this is an area where China and the rest of the world may run on separate tracks due to geopolitical tensions.”

The current low valuations in Chinese stocks are not enough to encourage investors to jump back into the markets, said Vasu Menon, investment strategy managing director at Oversea-Chinese Banking Corp. in Singapore. “Our suspicion is that they will provide more stimulus, but the question is whether it’s going to be sizable enough to appease the markets,” he said about Chinese policymakers.

The Bank of Japan started a two-day policy meeting Monday, and it is overwhelmingly forecast to leave its settings unchanged on Tuesday when it announces the results of its gathering.

Global benchmark Brent was little changed below $79 a barrel, while US counterpart West Texas Intermediate was near $73 a barrel. Libya’s National Oil Corp. said that flows from Sharara would resume after a three-week stoppage.

The dollar weakened versus most of its Group-of-10 peers, paring gains made earlier this month amid speculation the Fed’s policies would engineer a soft landing for the US economy.

Treasuries edged higher, with benchmark 10-year yields dropping one basis point. Benchmark notes had gained Friday as a “Fed-friendly” survey from the University of Michigan showed a mix of high consumer confidence and lower inflation expectations.

ADVERTISEMENT

CONTINUE READING BELOW

An exuberant melt-up phase in US stocks might already be underway and might become irrational, according to Ed Yardeni. “Unless Fed Chair Powell stresses that he’s in no rush to ease, a speculative bubble could inflate, funded by money moving from interest-paying vehicles into stocks and bonds,” he wrote in a note.

Investors will also be looking to Thursday’s first estimate of US fourth-quarter GDP, central bank meetings for Canada and Europe, along with South Korean economic output data and European initial readings of purchasing managers’ surveys of 2024.

Ron DeSantis dropped out of the the US presidential race to endorse Republican front-runner Donald Trump ahead of the New Hampshire primary on Tuesday.

Key events this week:

- US Conference Board leading index, Monday

- Bank of Japan rate decision, Tuesday

- Eurozone consumer confidence, Tuesday

- Netflix Inc. to report earnings; the streaming service is set to post a strong finish to 2023, Tuesday

- Japan trade, Wednesday

- Eurozone S&P Global Services & Manufacturing PMI, Wednesday

- UK S&P Global / CIPS Manufacturing PMI, Wednesday

- US S&P Global Services & Manufacturing PMI, Wednesday

- Tesla Inc., International Business Machines Corp. (IBM) to report earnings, Wednesday

- European Central Bank rate decision, Thursday

- Germany IFO business climate, Thursday

- US GDP, initial jobless claims, durable goods, wholesale inventories, new home sales, Thursday

- LVMH, Northrop Grumman Corp., SK Hynix Inc. to report earnings, Thursday

- Japan Tokyo CPI, Friday

- Bank of Japan issues minutes of policy meeting, Friday

- US personal income & spending, Friday

- The start of Lunar New Year celebrations in China, Friday

Stocks

- S&P 500 futures rose 0.3% as of 1:29 p.m. Tokyo time. The S&P 500 rose 1.2% on Friday

- Nasdaq 100 futures rose 0.6%. The Nasdaq 100 rose 2%

- Japan’s Topix index rose 1%

- Hong Kong’s Hang Seng Index fell 2%

- China’s Shanghai Composite Index fell 0.9%

- Australia’s S&P/ASX 200 Index rose 0.6%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0903

- The Japanese yen rose 0.2% to 147.88 per dollar

- The offshore yuan was little changed at 7.2064 per dollar

- The Australian dollar was unchanged at $0.6597

Cryptocurrencies

- Bitcoin fell 1.7% to $41,030.71

- Ether fell 2% to $2,423.65

Bonds

- The yield on 10-year Treasuries declined one basis point to 4.11%

- Japan’s 10-year yield was unchanged at 0.660%

- Australia’s 10-year yield declined six basis points to 4.23%

Commodities

- West Texas Intermediate crude rose 0.1% to $73.52 a barrel

- Spot gold fell 0.1% to $2 026.67 an ounce

This story was produced with the assistance of Bloomberg Automation.

© 2024 Bloomberg